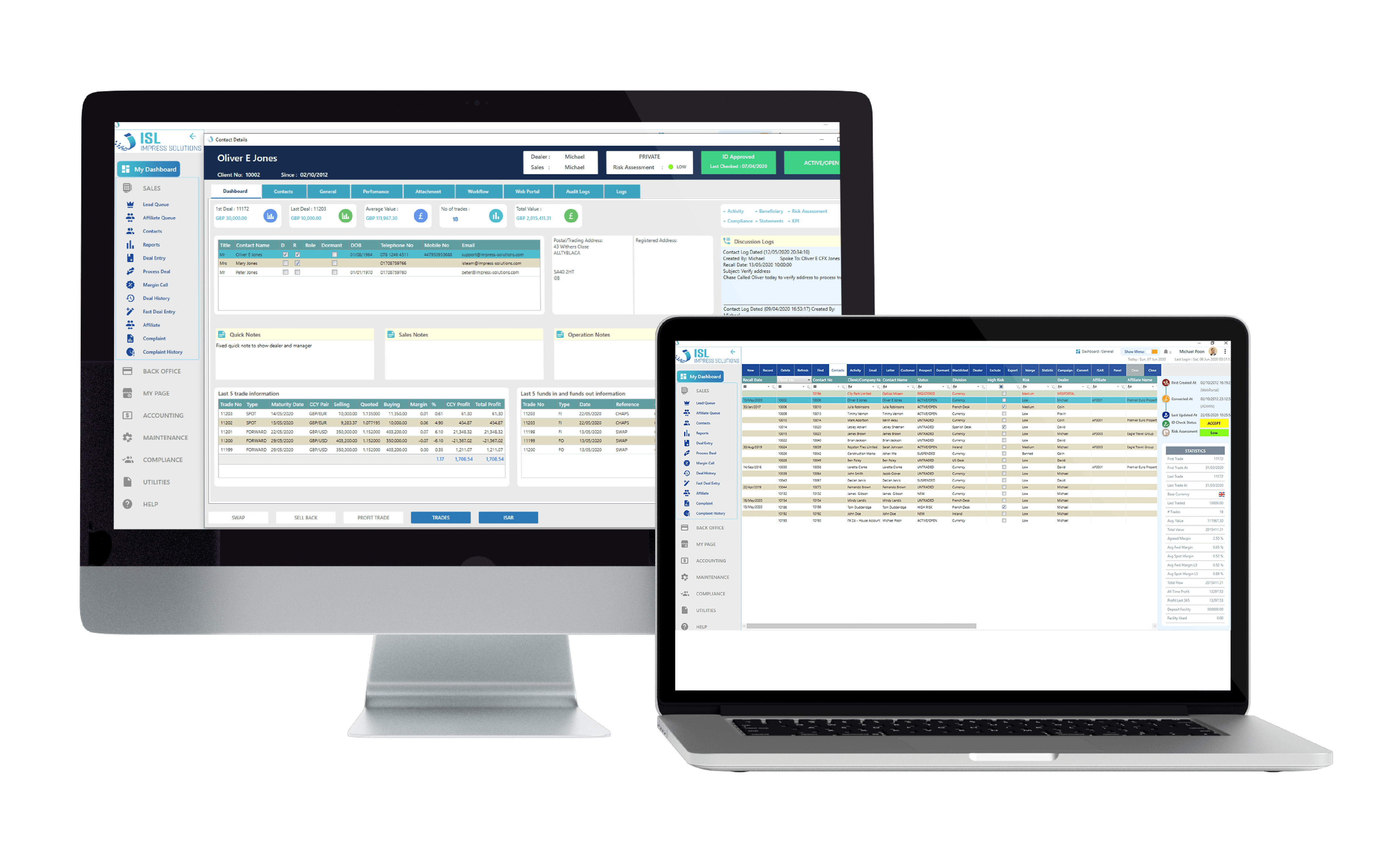

Complete FX solution to manage your Sales, KYC/Compliance, Trading, Risk, Treasury, and Finance operations

Developed using our 23 years of experience in the Forex and payment sectors, we have created a complete FX solution to manage your Sales, KYC/Compliance, Trading, Risk, Treasury, and Finance operations. Therefore leaving you to be able to focus on your trading activities.